With the July 13th deadline has arrived, many in the firearms world are going to have to learn new procedures in order to get ATF tax stamp approval for their NFA weapons. Anyone who doesn’t have their application to purchase a tax stamp through their trust tax postmarked by July 13th 2016 will have to comply with the new rules. As we know, tax stamps have been necessary for certain weapons, such as machine guns, short barreled rifles and shotguns, suppressors, and other items that the government decided (in their infinite wisdom) needed special regulation in the 1934 National Firearms Act (NFA). Before rule 41F, which goes into effect on July 13th, the NFA tax stamp could be acquired by a trust or legal entity, which would own the restricted weapons, without having to take many of the steps (such as CLEO approval, fingerprinting and photographing) that individuals had to take to own these weapons.

The new process is still a form driven event. The forms are available on the ATF website. The New ATF Forms

While the changes in the law that 41F makes means that the process of attaining an NFA item through a trust is no simpler than attaining one as an individual, the trust retains the added benefit of allowing more than one person to possess the item. Trusts that were set up before are “grandfathered in,” although any additional items placed into that trust in the future would have to comply with the updated rules.

As most of our members want to continue to use their trusts to gain that benefit of multiple people legally possessing the NFA item, we will focus our post on how to fill out these forms for a trust.

ATF FORM 1: TAX PAID APPLICATION TO MAKE AND REGISTER A FIREARM

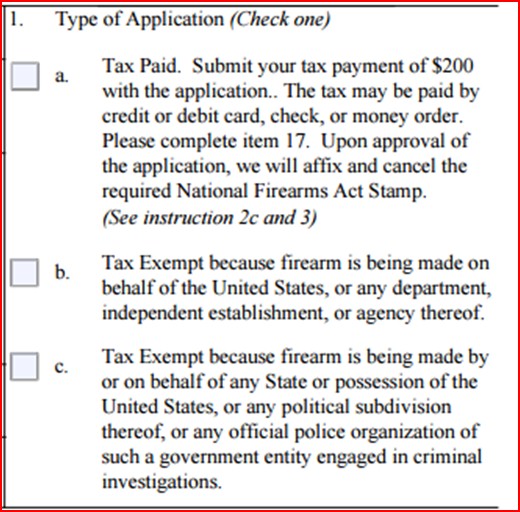

1) Type of Application: Most applicants will check box “a” for tax paid. Tax payment must be included with the application in the form of credit or debit card authorization, check or money order, payable to BATFE. We suggest a money order.

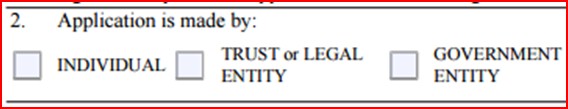

2) Check the box for application made by “Trust or Legal Entity.”

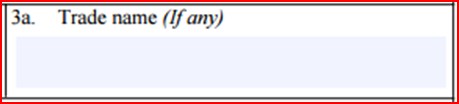

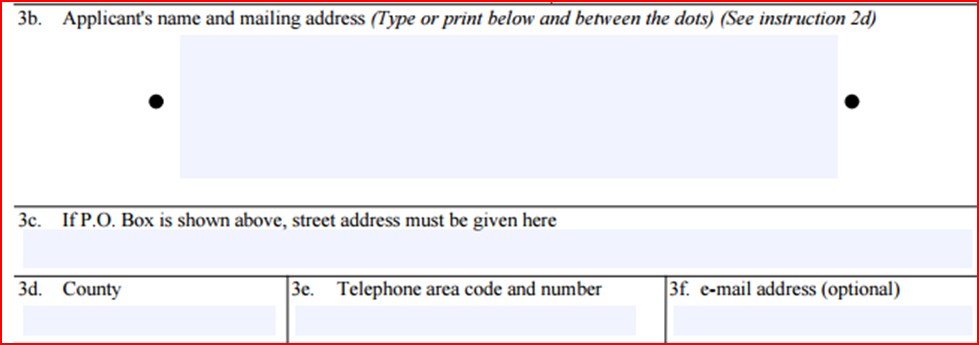

3) In 3(a) include trade name if any, 3(b) should include the applicants name and mailing address. As a trust you will simply include the complete name of the trust or legal entity but not any individual names that are the “responsible persons” in the trust. The address shown should be the full location in the particular state where the firearm will be maintained for a trust or legal entity. If a legal entity has multiple locations the address listed shall be the principal place of business. Box 3(c) should not be used as a trust, as the address given by a trust refers to where weapons are maintained, and in no instances should weapons be kept at in a post office box. Fill boxes 3(d), (e), and (f) accordingly.

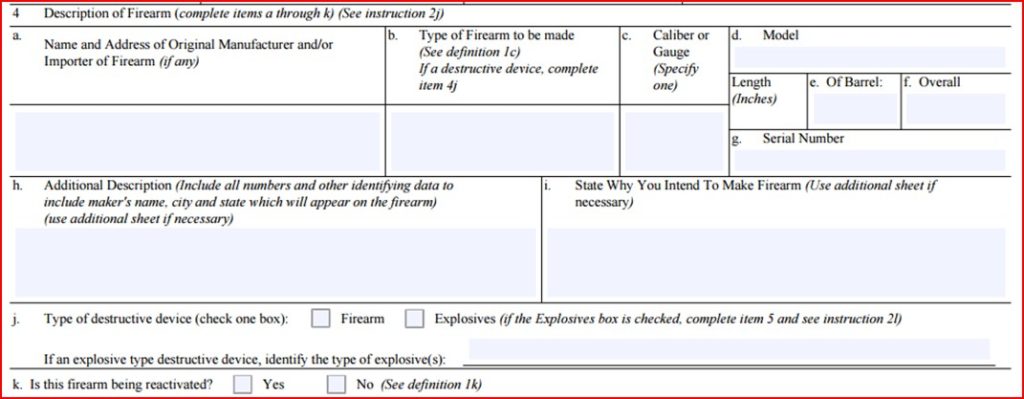

4) In section 4 the trust should fill out the particular information relating to the specific weapon being made. This is approved on a case by case basis, so the information shall be particular to exactly what you are making, down to precise measurements. 4(a) will include the name and address of the original manufacturer of the weapon, if it is an existing weapon that you are further manufacturing to where it will be an NFA restricted item. 4(b) will contain what type of restricted weapon you are making (e.g. “short barreled rifle”). 4(c) In this box you will specify the caliber or gauge of the weapon being manufactured. 4(d) Will contain the model designation written on the weapon. 4(e) Contains measurements of the barrel length. 4(f) contains overall measurements of the weapon (measured from extreme end to extreme end). 4(g) Contains the serial number of the weapon (not included on CLEO notificiation copy) 4(h) contains additional information, and shall include all numbers and other identifying data to include maker’s name, city and state which will appear on firearm (use additional sheet if necessary.) This is not the original manufacturers information, but rather your information. 4(i) Requires you to state why you intend to make the firearm. We recommend “Any lawful purpose” as it is a common response in this section. 4(j) Is only for destructive devices (make sure that it is legal to own in PA first), and asks whether the destructive device is an explosive or firearm. If it is an explosive a further explanation of what type of explosive is required (again, PA law is very specific on this). 4(k) asks if this is a firearm which is being reactivated, which the definitions say means “restoration of a registered unserviceable NFA firearm to a functional condition.)

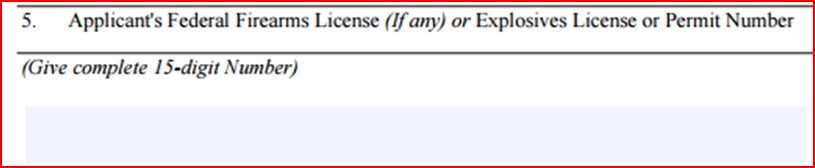

5) This is the space to fill in your FFL information, if you are one. It includes the space below which asks for your 15 digit license number, employee identification number, and class. If you are not an FFL, you leave it blank.

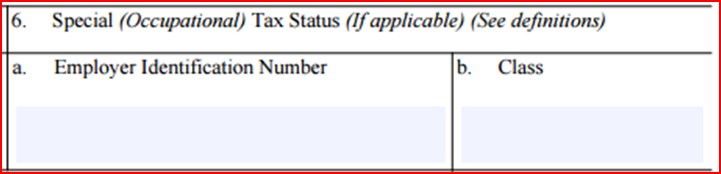

6) Box six asks if you have a special operations tax or SOT, which is required to be paid by an FFL engaged in the business of manufacturing (class 2), or importing (class 1) or dealing (class 3) NFA firearms. If you are not an FFL, you leave it blank.

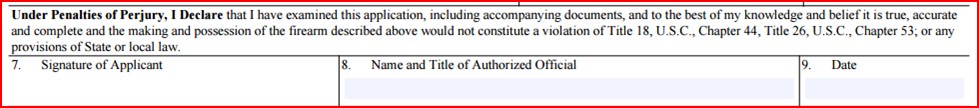

7) Box 7 requires a signature of Applicant, which for a trust or legal entity should be the signature of a responsible person. Keep in mind that the signatures must be in original blue or black ink on all copies of the Form 1, 4 or 5, as well as responsible persons questionnaire. You should sign it with the position that you hold such as “John Smith, Trustee.” Remember that this signature is completed under penalty of perjury.

8) Name and title of authorized official. You should sign it with the position that you hold such as “John Smith, Trustee.”

9) Date of the application.

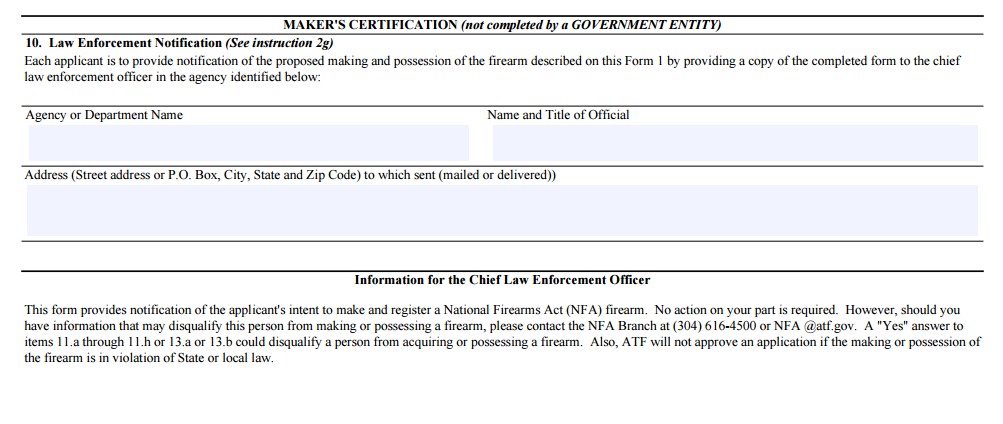

10) Requires notification to the Chief Law Enforcement officer (CLEO) who will be either the Chief of police, Sheriff, or other highest ranking law enforcement officer in your area (which is the area of the address provided in box 3b). In Pennsylvania this will be your local county Sheriff. This is a new section that trusts, corporations and individuals now need to fill out or you will be rejected. Include the department name, address, and name and title of the highest ranking official you are providing notification to, and the address of the agency or official. In addition to the Form 1, 4, or 5, a copy of the responsible persons questionnaire must be provided to CLEO for every responsible person on the trust to their respective heads of law enforcement.

The portion below is to be filled out by the BATFE and should not be filled out by you in any way.

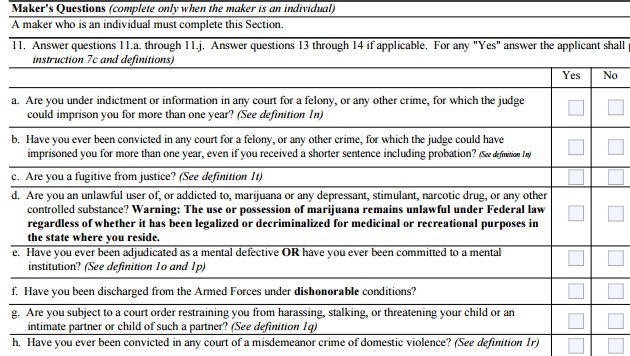

11) Trusts or legal entities should skip this part:

12) Trusts or legal entities skip the photograph part.

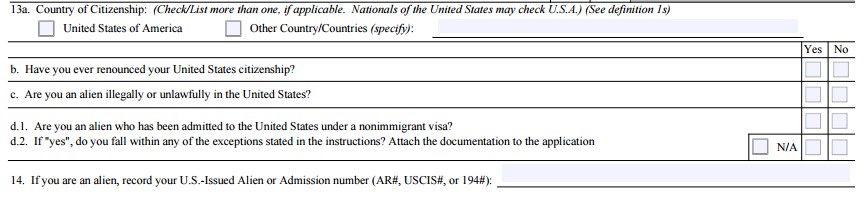

For Section 13 and 14, trusts or legal entities skip.

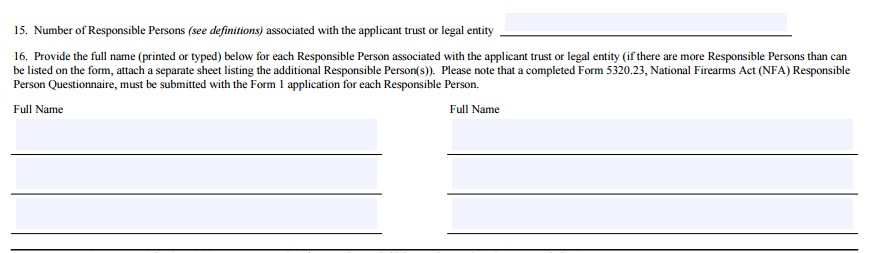

Section 15 is very important and is new for trusts. You must fill in the number of responsible persons associated with the trust or legal entity. In the definition section, we learn that “responsible persons” in the case of a trust are any individual who possesses directly or indirectly, the power or authority to direct the management and policies of the trust or entity to receive, possess, ship, transport, deliver, transfer or otherwise dispose of a firearm for, or on behalf of, the trust or legal entity. Examples of responsible persons for trusts may include “settlors/grantors, trustees, partners, members, officers, directors, board members, or owners.” Examples of someone who may not need to be listed may be a listed beneficiary of the trust, but only if the beneficiary does not have the capability to exercise the above listed enumerated powers or authorities.

16) In 16 you must list the full name, either printed or typed of each responsible person associated with the trust or legal entity. You must attach a separate sheet listing the additional responsible persons if you run out of room. Remember that a completed Form 5320.23 or “responsible persons questionnaire” must be submitted along with the Form 1, 4 or 5 for each responsible person, both to the ATF and to CLEO.

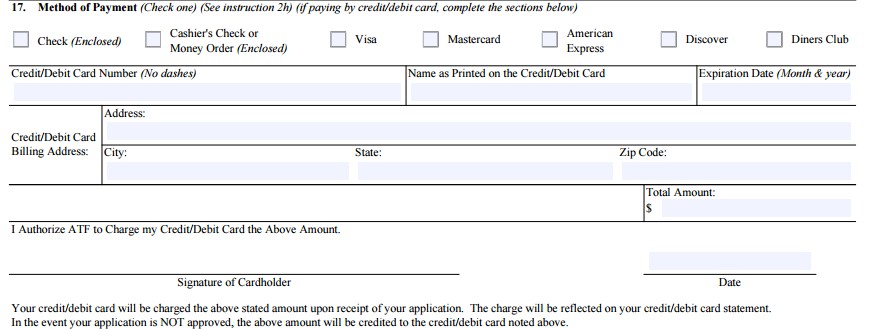

Section 17 is the payment information. It asks to check whether you are including a check, money order, or cashier’s check made payable to the BATFE, or asks for a signature, and date along with billing information for credit card authorization. This section is not included on the duplicate which is intended for CLEO.

***With 41F going into effect, you will now need, in addition to your check or money order, trust copy, or other documentation of legal entity status, and both copies of Form 1, Form 4, or Form 5 (all needed before) a 2×2 photograph, both FD-258 Fingerprint cards, and an ATF Form 5320.23 (also known as a responsible person’s questionnaire), which requires identifying information, such as responsible person’s name(s), address, dates and place of birth, and citizenship. See below instructions for filling out the responsible persons Form 5320.23.

HOW TO FILL OUT A FORM 4 APPLICATION FOR TAX PAID TRANSFER AND REGISTRATION OF FIREARM

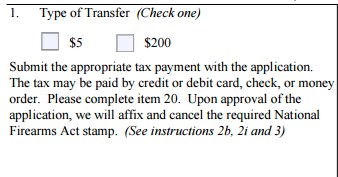

1) Fill out what type of transfer this is (either a firearm or destructive device which requires a $200 tax payment, or Any Other Weapon (AOW) which requires a $5.00 tax payment

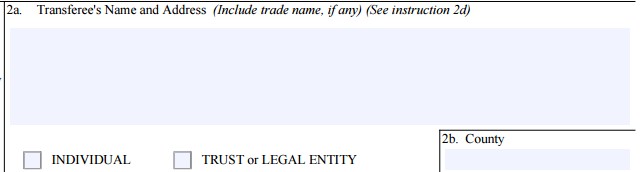

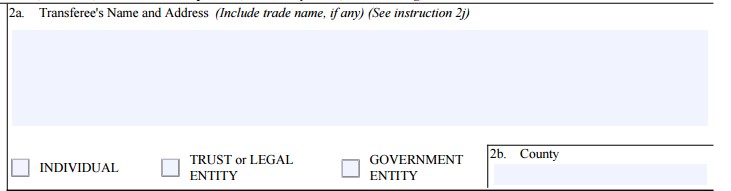

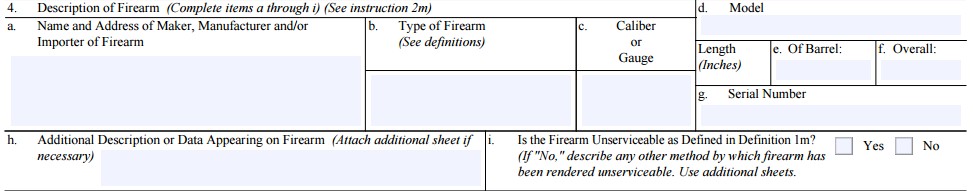

2) In box 2, check the trust or legal entity box. This is the information for the transferee, or the trust or legal entity acquiring the weapon. List the transferee’s name and address, including trade name if any. If a trust is the transferee, then use the address where the weapons are stored. Do not include the names or addresses of individuals. 2(b) contains the county where the trust is located.

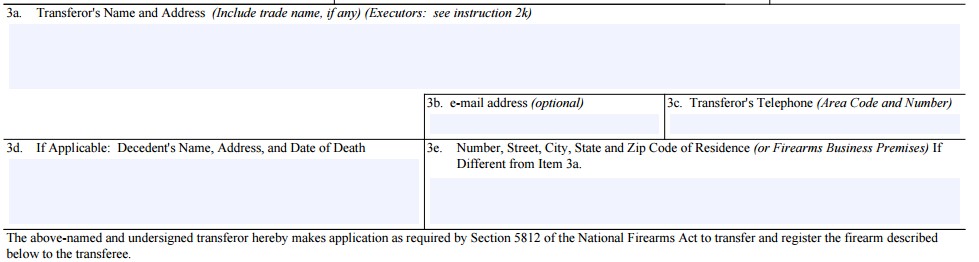

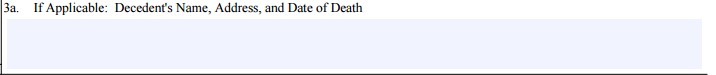

3) Section 3 is the transferor’s (the person selling, loaning, giving, or otherwise disposing of the weapon) information. 3(a) asks for the transferor’s name and address. Use the trust name and location of the stored firearms if the transferor is a trust or legal entity. If the item is being transferred tax exempt from an estate by bequest or interstate succession, or by other operation of law to a beneficiary or other authorized recipient, use ATF Form 5 instead of Form 4. 3(b) asks for an optional email address of the transferor. 3(c) requires a phone number for the transferor. 3(d) requires the decedent’s name, address, and date of death, if the items being transferred are from a deceased person’s estate. 3(e) requires the address of residence or firearms business premises if different than 3(a).

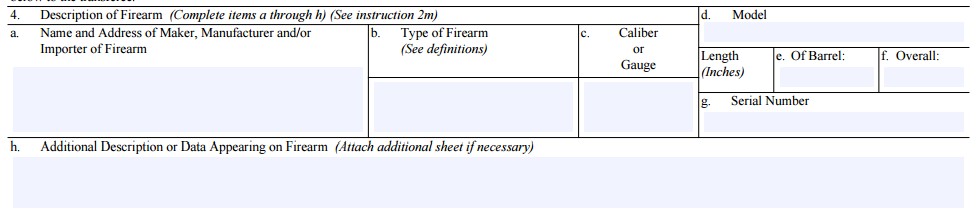

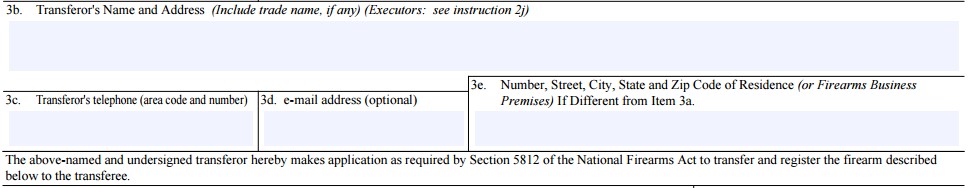

4) In section 4 the trust should fill out the particular information relating to the specific weapon being transferred. This is approved on a case by case basis, so the information shall be particular to exactly what you are transferring, down to precise measurements. 4(a) will include the name and address of the original manufacturer or importer of the weapon. 4(b) will contain what type of weapon is being transferred (e.g., “short barreled rifle”). 4(c) In this box you will specify the caliber or gauge of the weapon being transferred. 4(d) Will contain the model designation written on the weapon. 4(e) Contains measurements of the barrel length. 4(f) contains overall measurements of the weapon (measured from extreme end to extreme end). 4(g) Contains the serial number for the weapon. (The Serial Number is not included on the CLEO copy) 4(h) contains additional information, and shall include all numbers and other identifying data to include maker’s name, city and state which appears on firearm (use additional sheet if necessary.)

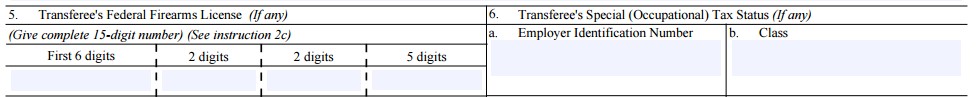

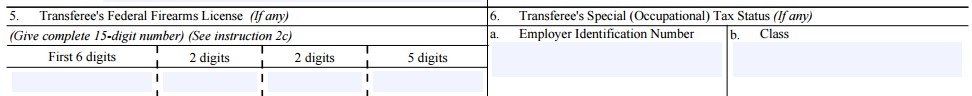

5) Transferee’s FFL number (if any)

6) Transferee’s Special Operations Tax (SOT), if any, including any Employee Identification Numbers, and class of FFL.

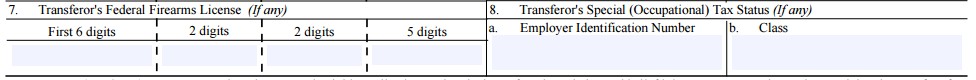

7) Transferor’s FFL if any.

8) Transferor’s Special Operations Tax (SOT), if any, including any Employee Identification Numbers, and class of FFL.

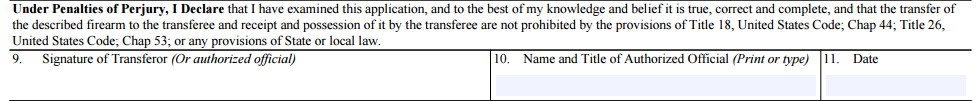

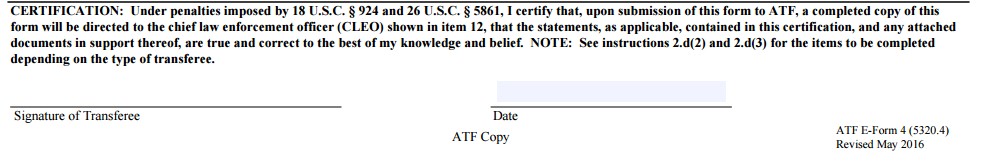

9) Signature or transferor (must be in original blue or black ink).

10) Name and title of authorized official acting on behalf of the trust or legal entity (e.g., John Smith as trustee).

11) Date of transfer.

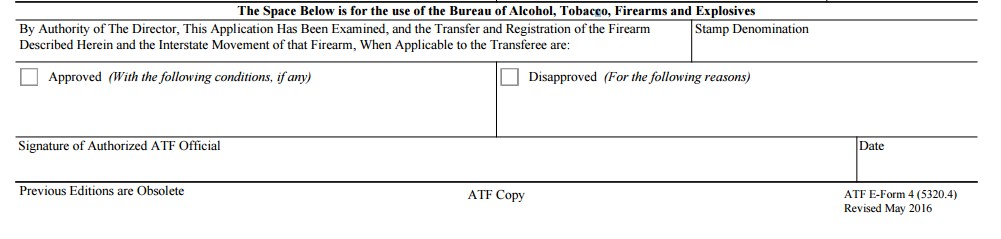

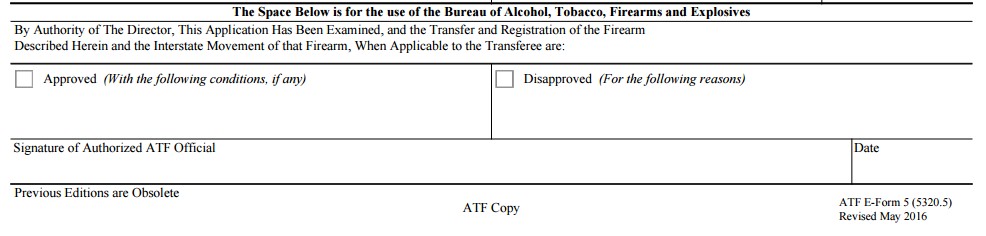

The portion below is to be filled out by the BATFE and should not be filled out by you in any way.

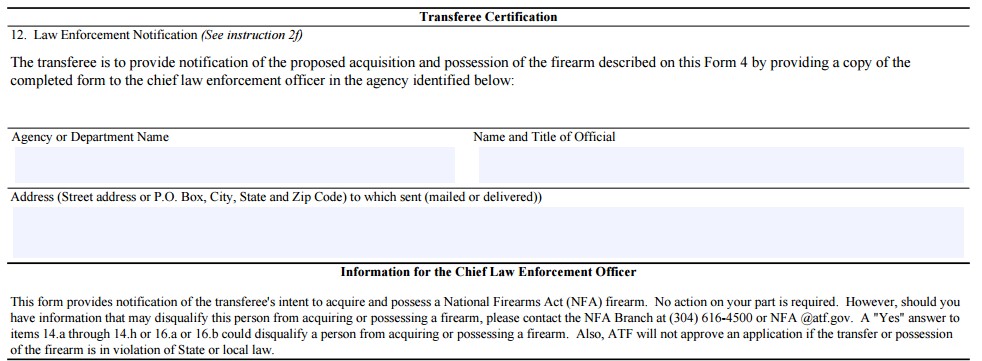

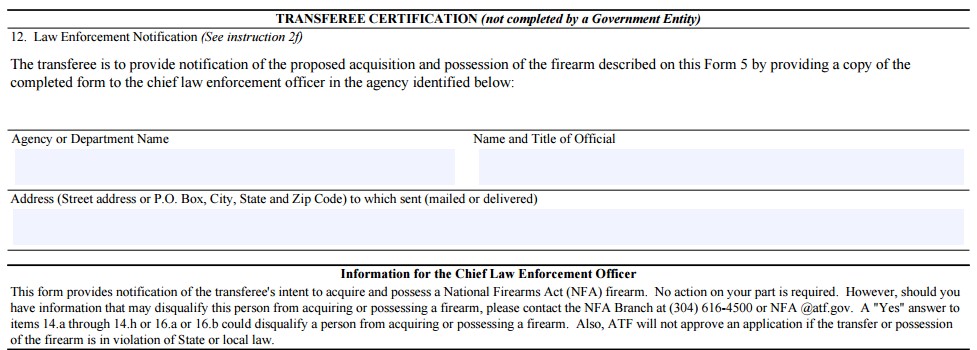

12) This section is new for trusts. It must be filled out. The transferee must provide notice to CLEO of the proposed acquisition and possession of the firearm described on this Form 4, by providing a copy of the completed form to the CLEOwith jurisdiction in the transferee’s area. In the case of a trust this is the area where the trust stores the firearms. As we are talking about Pennsylvania, this would be the local Sheriff’s Office.

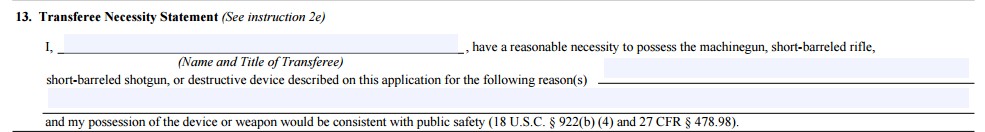

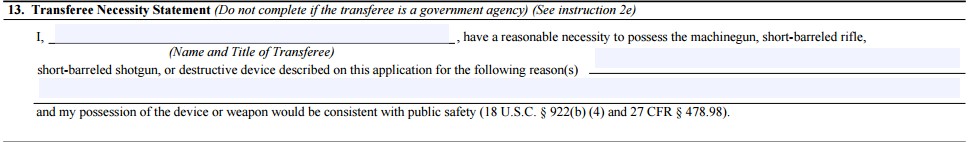

13) This must be completed if the firearm to be transferred is a machine gun, short barreled rifle or shotgun, AOW, or destructive device, regardless of whether the transferee is licensed to deal in such a device or firearm. This can be completed by saying “any lawful purpose.” You must also include a statement that possession of the device or weapon would be consistent with public safety.

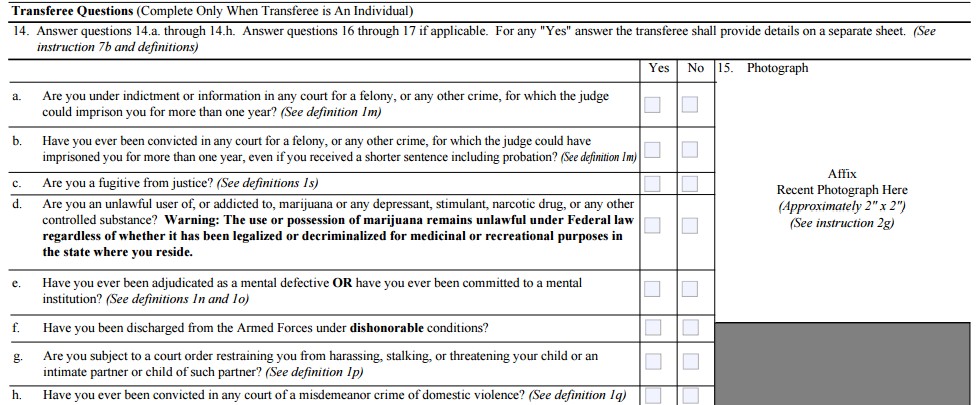

For trusts or Legal Entities skip sections 14 and 15.

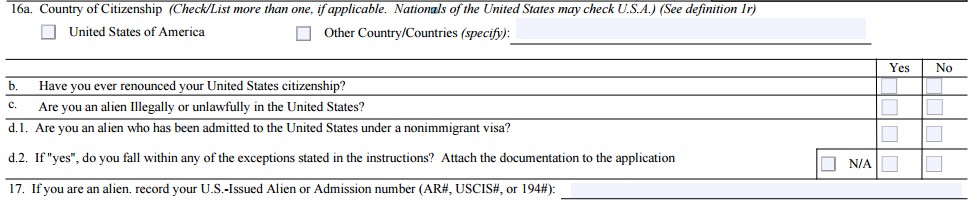

Trusts or Legal Entities can also skip Sections 16 and 17.

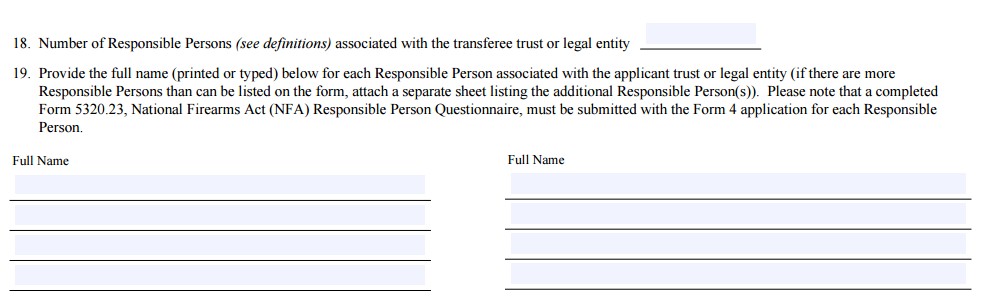

18) Fill in the number of responsible persons associated with the trust or legal entity. In the definition section, we learn that responsible persons in the case of a trust are any individual who possesses directly or indirectly, the power or authority to direct the management and policies of the trust or entity to receive, possess, ship, transport, deliver, transfer or otherwise dispose of a firearm for, or on behalf of, the trust or legal entity. Examples of responsible persons for trusts may include “settlors/grantors, trustees, partners, members, officers, directors, board members, or owners.” Examples of someone who may not need to be listed may be a listed beneficiary of the trust, if the beneficiary does not have the capability to exercise the above listed enumerated powers or authorities.

19) In 19 you must list the full name, either printed or typed of each responsible person associated with the trust or legal entity. Attach a separate sheet listing the additional responsible persons if you run out of room. Remember that a completed Form 5320.23 or “responsible persons questionnaire” must be submitted with the Form 1, 4 or 5 for each responsible person, both to the ATF and to CLEO.

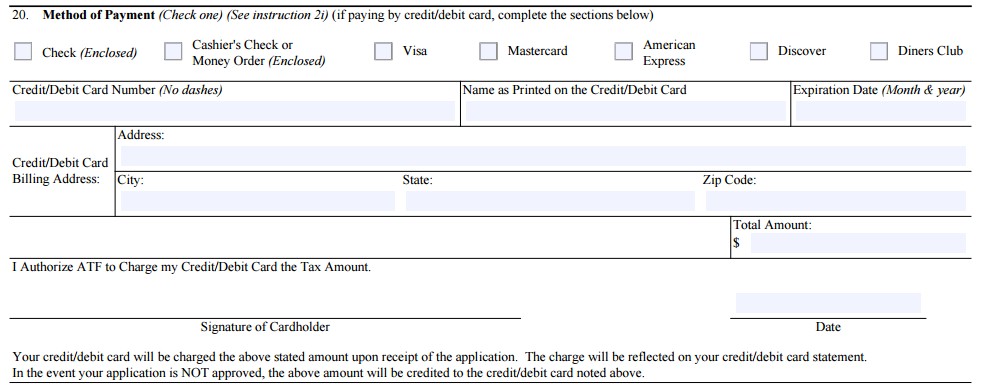

20) Is payment information and asks to check whether you are including a check, money order, or cashier’s check made payable to the BATFE, or asks for a signature, and date along with billing information for credit card authorization. This section is not included on the duplicate which is intended for CLEO.

*** With 41F going into effect, you will now need, in addition to your check or money order, trust copy, or other documentation of legal entity status, and both copies of Form 1, Form 4, or Form 5 (all needed before) a 2×2 photograph, both FD-258 Fingerprint cards, and an ATF Form 5320.23 (also known as a responsible person’s questionnaire), which requires identifying information, such as responsible person’s name(s), address, dates and place of birth, and citizenship. See below instructions for filling out the responsible persons Form 5320.23.

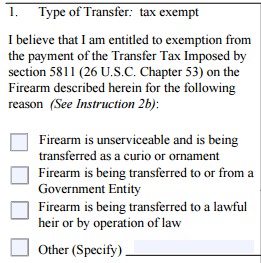

HOW TO FILL OUT ATF FORM 5 APPLICATION FOR TAX EXEMPT TRANSFER OF FIREARM

In Section One, this is where you would explain why you believe you qualify for a tax exempt transfer by checking the appropriate box. If you do not qualify for any of the exemptions, you can either specify “other” and explain, or you may have to use a Form 4 tax paid transfer.

2) For section two, check the box that says trust of legal entity. This is the information for the transferee, or the trust or legal entity acquiring the weapon. List the transferee’s name and address, including trade name if any. If a trust is the transferee use the address where the weapons are stored. Do not include the names or addresses of individuals. 2(b) contains the country where the trust is located.

3) Section 3 is the transferor’s (the person selling, loaning, giving, or otherwise disposing of the weapon) information. 3(a) asks for the transferor’s name and address. Use the trust name and location of the stored firearms if the transferor is a trust or legal entity. Subsection (b) asks for an optional email address of the transferor. 3(c) requires a phone number for the transferor. 3(d) requires the decedent’s name, address, and date of death, if the items being transferred are from a deceased person’s estate. 3(e) requires the address of residence or firearms business premises if different than 3(a).

4) In section 4, the trust should fill out the particular information relating to the specific weapon being transferred. This is approved on a case by case basis, so the information shall be particular to exactly what you are transferring, down to precise measurements. 4(a) will include the name and address of the original manufacturer or importer of the weapon. 4(b) will contain what type of weapon is being transferred (e.g., “short barreled rifle”). 4(c) In this box you will specify the caliber or gauge of the weapon being transferred. 4(d) Will contain the model designation written on the weapon. 4(e) Contains measurements of the barrel length. 4(f) contains overall measurements of the weapon (measured from extreme end to extreme end). 4(g) Contains the serial number for the weapon. (The Serial number is not included on the CLEO copy) 4(h) contains additional information, and shall include all numbers and other identifying data to include maker’s name, city and state which appears on firearm (use additional sheet if necessary.)

5) Transferee’s FFL number (if any)

6) Transferee’s Special Operations Tax (SOT) if any, including any Employee Identification Numbers, and class of FFL.

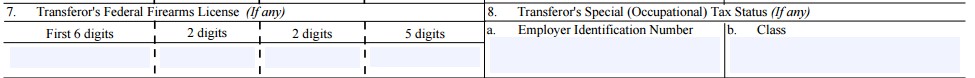

7) Transferor’s FFL if any.

8) Transferor’s Special Operations Tax (SOT) if any, including any Employee Identification Numbers, and class of FFL.

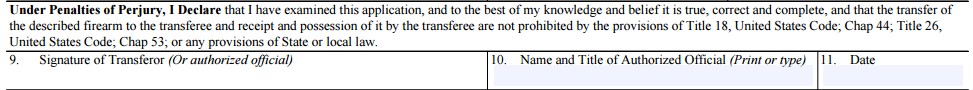

9) Signature or transferor (must be in original blue or black ink).

10) Name and title of authorized official acting on behalf of the trust or legal entity (print of type).

11) Date of transfer.

12) This is a new section for trusts to fill out. You must fill it out. The transferee must provide notice to CLEO of the proposed acquisition and possession of the firearm described on this Form 4, by providing a copy of the completed form to the CLEO with jurisdiction in the transferee’s area. In the case of a trust this is the area where the trust stores the firearms. As we are in Pennsylvania, you must notify the elected Sheriff of the county.

13) This must be completed if the firearm to be transferred is a machine gun, short barreled rifle or shotgun, AOW, or destructive device, regardless of whether the transferee is licensed to deal in such a device or firearm. This can be completed by saying “any lawful purpose.” You must also include a statement that possession of the device or weapon would be consistent with public safety.

Trusts or Legal Entities skip Sections 14 and 15.

Trusts or Legal Entities skip Sections 16 and 17.

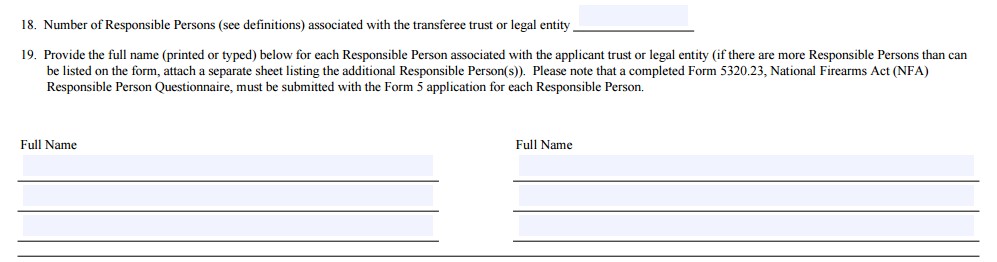

18) Fill in the number of responsible persons associated with the trust or legal entity. In the definition section, we learn that “responsible persons” in the case of a trust are any individual who possesses directly or indirectly, the power or authority to direct the management and policies of the trust or entity to receive, possess, ship, transport, deliver, transfer or otherwise dispose of a firearm for, or on behalf of, the trust or legal entity. Examples of responsible persons for trusts may include “settlors/grantors, trustees, partners, members, officers, directors, board members, or owners.” Examples of someone who may not need to be listed may be a listed beneficiary of the trust, if the beneficiary does not have the capability to exercise the above listed enumerated powers or authorities.

19) In 19 you must list the full name, either printed or typed of each responsible person associated with the trust or legal entity. Attach a separate sheet listing the additional responsible persons if you run out of room. Remember that a completed Form 5320.23 or “responsible persons questionnaire” must be submitted with the Form 1, 4 or 5 for each responsible person, both to the ATF and to CLEO.

*** With 41F going into effect, you will now need, in addition to your trust copy, or other documentation of legal entity status, and both copies of Form 1, Form 4, or Form 5 (all needed before) a 2×2 photograph, both FD-258 Fingerprint cards, and an ATF Form 5320.23 (also known as a responsible person’s questionnaire), which requires identifying information, such as responsible person’s name(s), address, dates and place of birth, and citizenship. See below instructions for filling out the responsible persons Form 5320.23.

HOW TO FILL OUT ATF FORM 5320.23 RESPONSIBLE PERSON QUESTIONNAIRE

1) Check which Form this is questionnaire is accompanying (either Form 1, 4, or 5)

![]()

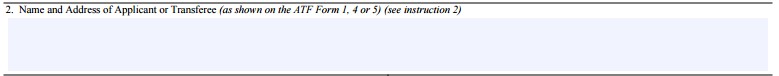

2) Fill in the name and address of the transferee. For a trust or legal entity on Form 1 enter the address in item 3(a and b); For Form 4 (item 2a); For Form 5 (item 2a)

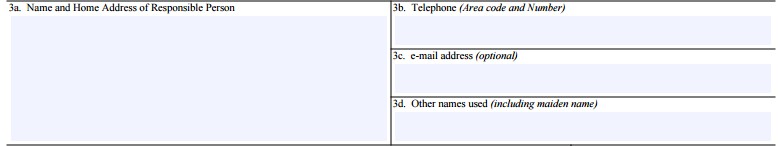

3) Enter information for the responsible person addressed in this questionnaire. 3(a) is the person’s name and home address, 3(b) is a telephone number for the person, 3(c) is optional, and is not included on the CLEO copy, and is an email address for the person, 3(d) is other names used, which includes maiden names, and 3(e) is where a 2×2 photograph should be attached. The photo should be a frontal view taken within a year prior to the date of filing of the form. Your face and head must not be obscured.

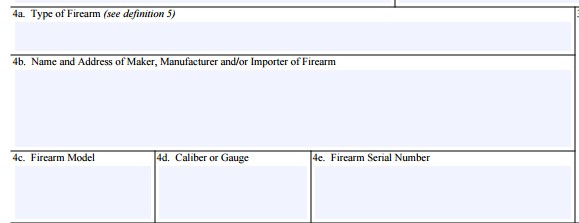

4) Item 4 is the firearm information for what is being transferred or made. 4(a) asks for the type of firearm (item 4b on Form 1, 4, or 5); 4(b) asks for the make, manufacturer or importer of the firearm (item 4a on Form 1, 4, or 5); Item 4(c) asks for the firearm model (item 4d on the Form 1, 4, or 5); Item 4(d) asks for the caliber or gauge of the weapon (item 4c on the Form 1, 4, or 5); Item 4(e) asks for the firearm serial number (item 4g on Form 1, 4, or 5), item 4(e) which is the serial number is not included on the CLEO copy.

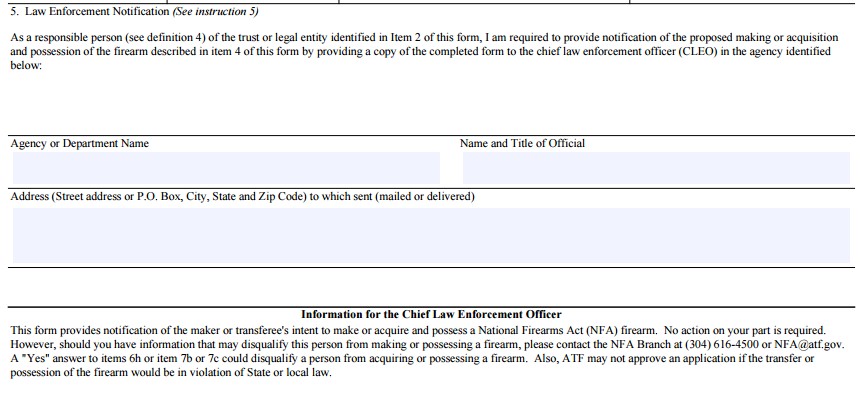

5) Item 5 requires responsible persons (in the case of an unlicensed entity (including a trust) defined as: any individual who “possesses, directly or indirectly, the power or authority to direct the management and policies of the trust or entity to receive, possess or ship, transport, deliver, or otherwise dispose of a firearm for, or on behalf of the trust, or legal entity”) to complete this form. In item 5 fill out the agency or department name and address, and the name or title of the CLEO you are sending the form to. As we are in Pennsylvania, this is the local county sheriff’s office.

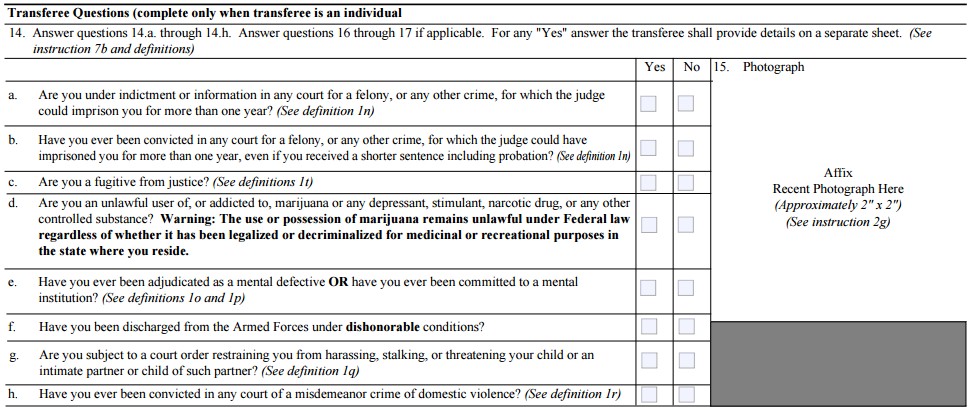

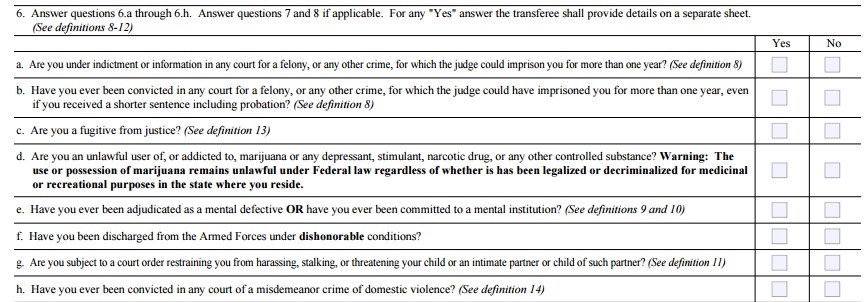

6) Item 6 (a-h) asks questions that are standard from a Form 4473, which is the normal NICS instant background check form. Answer these questions accordingly, and honestly.

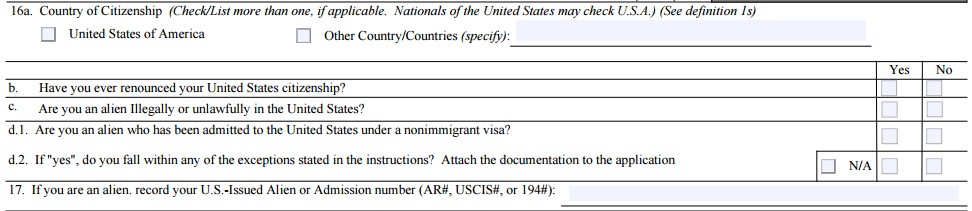

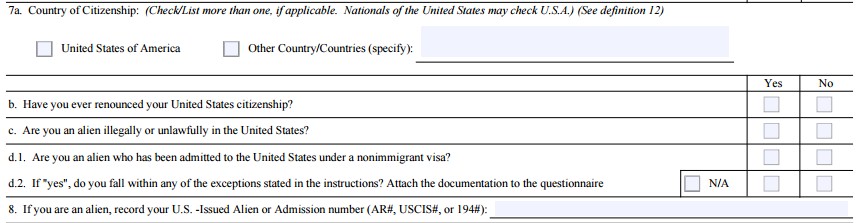

7) Answer 7(a) with your country of Citizenship. If you have more than one, you can check and list them. Answer 7(b-d(2)) accordingly and honestly, attaching additional documentation if needed to explain why you fall in any of the excepted categories listed in the instructions if need be.

8) Answer item 8 if you are an alien by recording your U.S. issued Alien or Admission number.

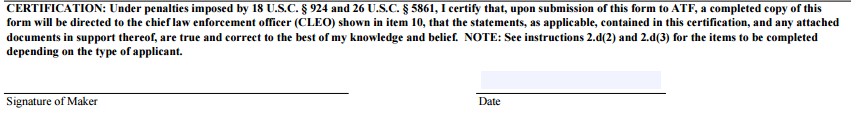

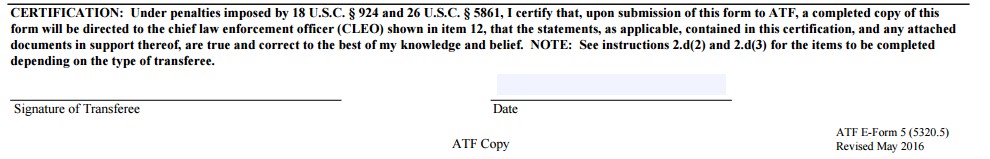

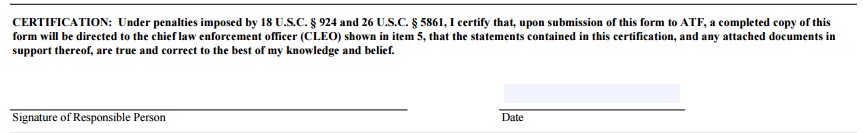

You must then sign and date the form, under penalty of perjury. The signature must be in original blue or black ink. The signature also certifies that you will, upon submission of this form to the ATF, attach a completed copy of this form to the CLEO shown in item 5.

In addition to this form, you must submit to the ATF (but not the CLEO) fingerprints on FBI Form FD-258. The fingerprints must be clear enough for accurate classification, and taken by someone properly equipped to take them.

If the State in which the responsible person resides requires a State or local permit or license, a copy of the permit or license should be submitted with this form. If the listed person is in PA, then you do not need to include your PA LTCF.

Remember this questionnaire has to be filled out by each responsible person in the trust.

The ATF copy of the Form should be submitted, with the fingerprints and photograph, and (2) copies of the ATF Form 1, 4, or 5.

**NOTES TO REMEMBER:**

- Two (2) copies of the Form 1 or Form 4, or Form 5 must be sent to the ATF. These copies need to be printed on paper DOUBLE SIDED. They also both need to be completed with blue or black ink, and the signature on both copies must be in original ink. (Don’t make one, and then just color copy it)

- You must also include (2) Fingerprint cards for each responsible person

- The copy of the trust should be printed (1) sided

- The 2×2 photo must show a frontal view without head coverings or hats for each responsible person

- The Check or Money Order must be payable to the BATFE

- The Responsible Person questionnaire must be completed by all responsible persons as defined above

- Any application not post marked by July 13th 2016 must abide by the new regulations discussed here, and use the new application forms available on the ATF website.

[This post was a collaboration of Gil Ambler and Justin J. McShane]